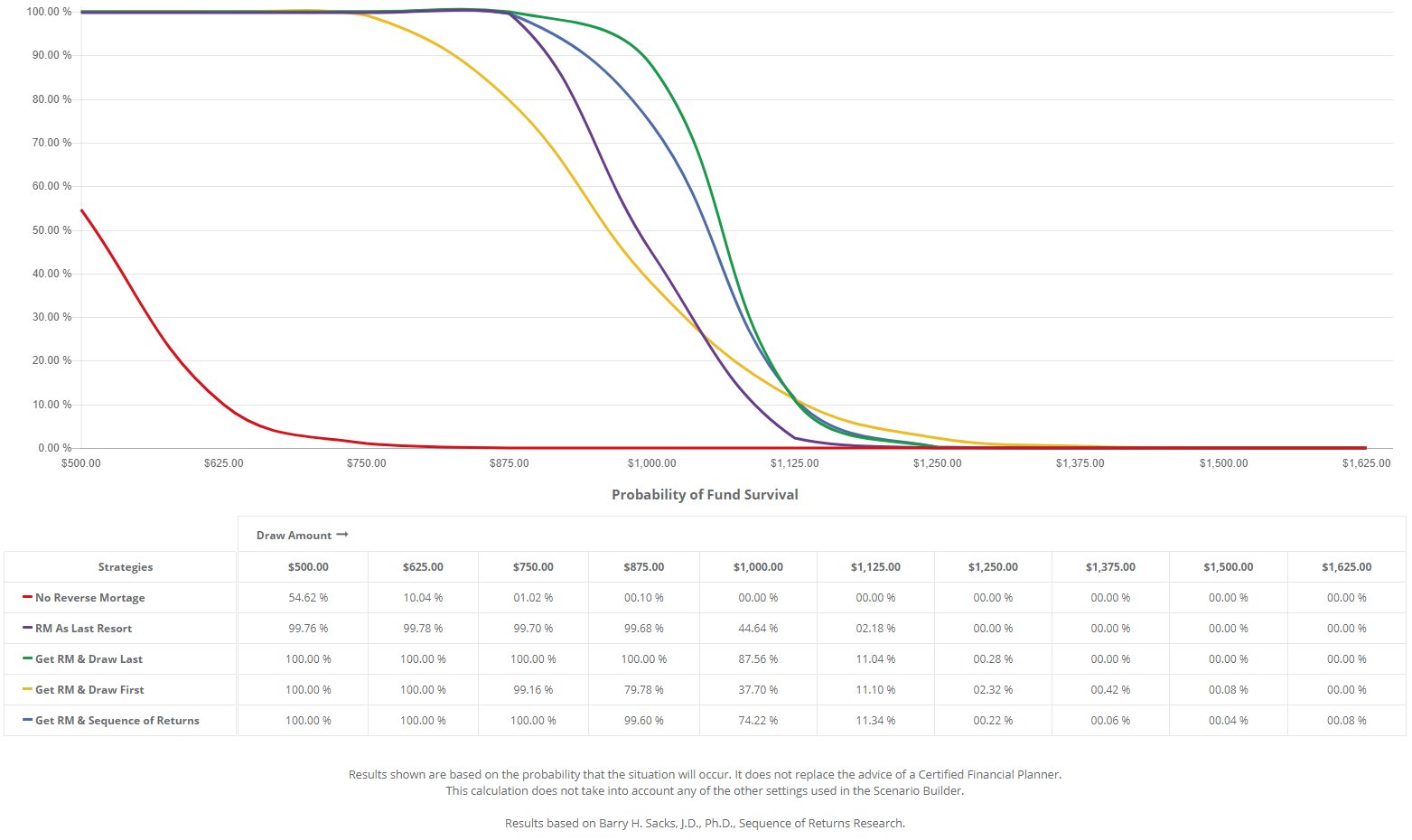

For some retirees, a standby reverse mortgage strategy combined with their saving may increase their chances of meeting their retirement goals. They would draw on a reverse mortgage when the financial markets are correcting and their account values are down and preserve their retirement accounts.

This chart shows a sample scenario for a married couple. They have a house worth $300,000 with an existing mortgage of $100,000. For retirement assets they have:

| Assets in Bank Account | $50,000 |

| Assets in Bonds or CDs | $50,000 |

| Assets in Stocks | $50,000 |

| Expected Rate of Return | 4.985% |

| Expected Rate of Inflation | 2.000% |

| Current Age of Youngest | 65 |

| Planning Through Age | 95 |

The colored lines show how much money they could draw from their sources per month and the chances at various draw amounts of their funds being exhausted.

This chart is based the article “Reversing the Conventional Wisdom: Using Home Equity to Supplement Retirement Income” by Barry H. Sacks, J.D., Ph.D.; and Stephen R. Sacks at http://materials.legalspan.com/fpanet/group/535034f8-9274-4be4-9cf1-7b9c45396113/article.pdf. This paper looks at different strategies for using a reverse mortgage credit line to increase the safe maximum initial rate for taking money out of retirement accounts.

If you would like an analysis based on your situation, then Contact Us.